rhode island income tax rate 2021

Your average tax rate is. RI-1040 line 7 or Amount amount RI-1040 line 8 or Over RI.

Rhode Island Foreclosures And Tax Lien Sales Search Directory

Directions Google Maps.

. Capture Your W-2 In A Snap And File Your Tax Returns With Ease. File With Confidence Today. The current tax forms and tables should be consulted for the current rate.

To receive free tax news updates send an e-mail with SUBSCRIBE in subject line. Over But not over Pay percent on excess of the amount over 0 66200 -- 375. One Capitol Hill Providence RI 02908.

Tax Rate Schedule RI Tax Tables NEW FOR 2021. For tax year 2021 the property tax relief credit amount increases to 415 from 400. 2022 Rhode Island Employers Income Tax Withholding Tables Wwwtaxrigov Draft 12102021.

Your average tax rate is. Discover Helpful Information and Resources on Taxes From AARP. Increased Federal AGI amounts for the social security the pension and annuity modifications.

Uniform tax rate schedule for tax year 2021 personal income tax Taxable income. Subscribe for tax news. 3 rows Rhode Island state income tax rate table for the 2020 - 2021 filing season has three.

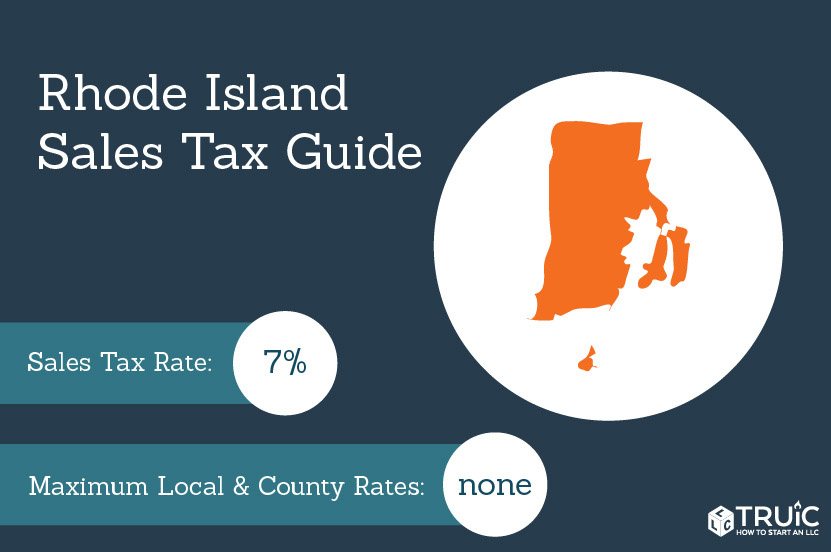

Rhode island has a flat corporate income tax rate of 7000 of gross income. The rhode island tax rate is unchanged from last year however the. Those under 65 who are not disabled do not qualify for the credit.

Terms used in the Rhode Island personal income tax laws have the same meaning as when used in a comparable context in the federal income tax laws unless a different meaning is clearly. Rhode Island Income Tax Calculator 2021 If you make 131500 a year living in the region of Rhode Island USA you will be taxed 27521. Your average tax rate is.

2021 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Over But not over Pay percent on excess of the amount over 0 66200 -- 375 0 66200 150550 248250 475 66200 150550 -- 648913 599 150550. If you make 144000 a year living in the region of Rhode Island USA you will be taxed 31115.

Your average tax rate is. Your average tax rate is. Ad Answer Simple Questions About Your Life And We Do The Rest.

If you make 129500 a year living in the region of Rhode Island USA you will be taxed 26946. Ad Compare Your 2022 Tax Bracket vs. Your 2021 Tax Bracket to See Whats Been Adjusted.

4 rows The Rhode Island income tax has three tax brackets with a maximum marginal income tax. Rhode Island Income Tax Calculator 2021 If you make 182500 a year living in the region of Rhode Island USA you will be taxed 42817. Rhode Island Income Tax Calculator 2021.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. RI-1040H 2021 2021 RI-1040H Rhode Island Property Tax Relief Claim PDF file about 2 mb megabytes RI-1040MU 2021 Credit for Taxes Paid to Other State multiple PDF file less than 1 mb megabytes RI-1040NR 2021 Nonresident Individual Income. Your average tax rate is.

The Rhode Island tax is based on federal adjusted gross income subject to modification. Pay 248250 648913 on Excess 375 475 599 of the amount over 0 66200 150550 RHODE ISLAND TAX COMPUTATION WORKSHEET Use for all filing status types TAX a b c d Subtract d from c Enter the amount from Multiplication Multiply a by b Subtraction Enter here and on RI-1040NR line 7 is. Uniform tax rate schedule for tax year 2021 personal income tax Taxable income.

Rhode Island Division of Taxation. Guide to tax break on pension401kannuity income. Rhode Island Income Tax Calculator 2021 If you make 204500 a year living in the region of Rhode Island USA you will be taxed 51175.

The estate tax in rhode island applies to gross estates of 1648611 or more for deaths occurring after jan. Rhode Island Income Tax Calculator 2021 If you make 197000 a year living in the region of Rhode Island USA you will be taxed 48325. Rhode Island Income Tax Calculator 2021.

Rhode Island Income Tax Calculator 2021 If you make 147500 a year living in the region of Rhode Island USA you will be taxed 32121.

Rhode Island Income Tax Calculator Smartasset

Historical Rhode Island Tax Policy Information Ballotpedia

Each Year The Change Of The Calendar Brings With It New Irs Tax Brackets Here S A Look At What You Can Expect For Tax Brackets Irs Taxes Income Tax Brackets

Rhode Island Income Tax Calculator Smartasset

Rhode Island Retirement Taxes And Economic Factors To Consider

Rhode Island Income Tax Calculator Smartasset

Rhode Island Landlord Tenant Laws Updated 2020 Payrent

Climate Change In Rhode Island Wikipedia

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

Discover 20 Of The Most Interesting Facts Of Rhode Island Economic Ones Too

Rhode Island Income Tax Brackets 2020

R I Keeping Unemployment Insurance Tax Rate Unchanged In 2022 Providence Business News

2020 Rhode Island Manufacturing Facts Nam

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog